Want to start in the stock market? Don’t be afraid! My experience and these simple tips will help you invest smartly.

Investing in the stock market can seem a little scary, especially when you are new. I myself used to get scared many times in the beginning and wondered, “Am I making the right decision?” But gradually, as I learned, I adopted some simple and effective methods that worked for me. Let me explain to you based on my experience.

1. Get educated before investing

Investing in the stock market is not a lucky draw. I too initially thought that only investing money would yield profits, but I quickly learnt that knowledge is the greatest power.

- What to do: Read about stocks, indices, IPOs, mutual funds.

- How to learn: YouTube videos, finance blogs, and books (like “Rich Dad Poor Dad”).

- My learning: Only when I took the time to understand the market did I feel confident about investing.

2. Start small

I never started with a big amount. Investing ₹5000-₹10000 in the beginning worked fine for me.

- This reduces fear and you do not feel afraid of making a mistake.

- With small investments, you can gradually understand the market.

- My Experience: When I invested in small stocks, I started understanding market movements.

3. Research is important

Before investing in any company, it is very important to see its financial reports, profits, losses, and market trends .

- I initially bought the stock on the advice of friends and incurred losses.

- But when I did my own research, my investment went in the right direction.

- Tip: Always do at least 10 minutes of online research about the company.

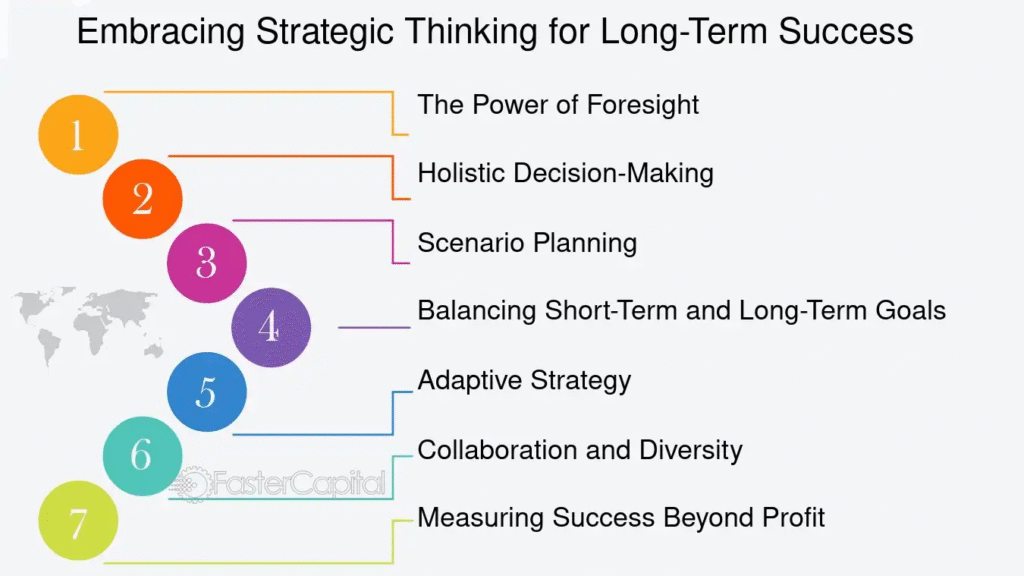

4. Think long-term

The short-term rise or fall will start scaring you. This lesson has been very important for me that it is important to be patient.

- Market fluctuations are common.

- I thought about selling several times in my first year, but patience made my investment grow.

- You can also take advantage of compounding through long-term investments .

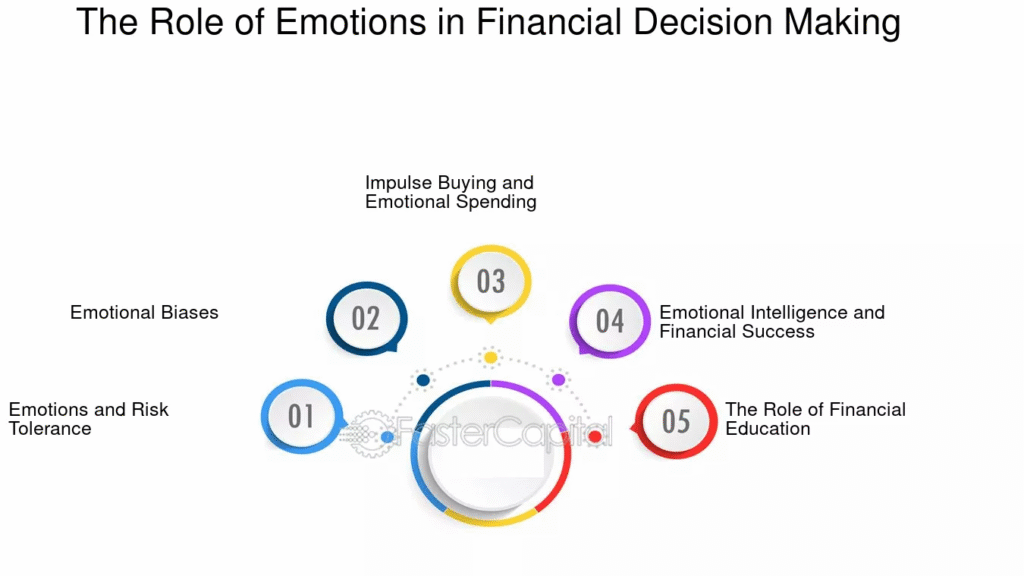

5. Control your emotions

Fear and greed are the biggest obstacles in investing.

- When stocks fall, selling out of fear is common.

- When stocks rise, it’s common to overinvest out of greed.

- My experience: I made the mistake of giving in to both these emotions the first time. Now I always make decisions after careful consideration.

6. Diversify

It is risky to put all your money into just one stock.

- I always divide my money into 2-3 sectors and different companies .

- Due to this, even if a stock falls, the loss is reduced.

- Example: Small investments in IT, FMCG and banking sectors.

7. Keep learning continuously

The market changes every day. I take out some time every week to understand new companies, policies and trends.

- This increases confidence in investment.

- The biggest mistake is to stop learning.

Stock Market 2025 – Easy Guide Table for Beginner Investors

| Step | What to do | My Learning / Personal Tip | to bear in mind |

|---|---|---|---|

| 1. Get educated | Read about Stock Market, IPO, Mutual Funds | Initially I learned from YouTube and blogs | Don’t just rely on hearsay or advice from friends |

| 2. Start small | Start investing from ₹5000-₹10000 | Small investments reduce fear and provide an opportunity to learn the market | Don’t invest a large amount of money upfront |

| 3. Do your research | Check company reports, profit-loss, market trends | I did my research and chose the right stocks | Do your own research instead of relying on friends’ opinions |

| 4. Think long-term | Invest for 1 year or more | Patience boosts investment | Don’t be afraid of market fluctuations |

| 5. Control your emotions | Avoid fear and greed | First I made a mistake out of fear and greed | Just make a decision wisely |

| 6. Diversify | Investment in different sectors and companies | Small investments in IT, FMCG, Banking | Don’t invest all your money in one stock |

| 7. Keep learning | Follow market trends, new companies | Spend some time every week understanding the market | Never stop learning |

Starting out in the stock market can seem scary, but starting small, research, patience, and learning make it easier. In my experience, even beginner investors can make smart and safe investments.

This blog is for educational and informational purposes only. Consult your financial advisor before investing in any stock . There is always risk in investing.

#StockMarketIndia #InvestmentTips #FinanceForBeginners #Carrerbook Anslation #MoneyMatters #InvestSmart #StockMarketTips #PersonalFinance #LongTermInvestment #FinancialFreedom #OpenStockGuide