In 2025, smart budgeting isn’t just an option, it’s a necessity. Rising inflation, changing income sources, and rapidly evolving lifestyles have made proper financial management even more crucial. Smart budgeting isn’t just about reducing expenses, but about managing your money in a way that allows you to achieve both short-term goals (like trips, buying gadgets) and long-term goals (like retirement planning, buying a home).

In this article, we’ll explore 10 easy and practical ways to help you practice smart budgeting in 2025.

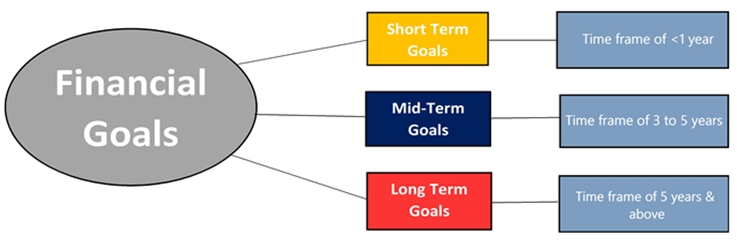

1. Set Clear Financial Goals

Caption: “Without a goal, your budget is just a wish list.”

The first step is to set clear financial goals.

- Divide your goals into Short-term (1 year) , Mid-term (1-5 years) and Long-term (5+ years) .

- Example:

- Short-term: Creating an Emergency Fund (₹50,000)

- Mid-term: Car Down Payment (₹3-4 लाख)

- Long-term: Retirement Fund (₹1 crore+)

Pro tip: Write down your goals and check in every month to see if you’re on track.

2. Track Every Rupee You Spend

Caption: “You can’t control what you don’t measure.”

You should know where your money is going.

- Use Expense Tracker App like Walnut, MoneyView, GoodBudget.

- Also note small daily expenses (Tea, Coffee, Snacks).

- Check the report at the end of the month to see where cuts can be made.

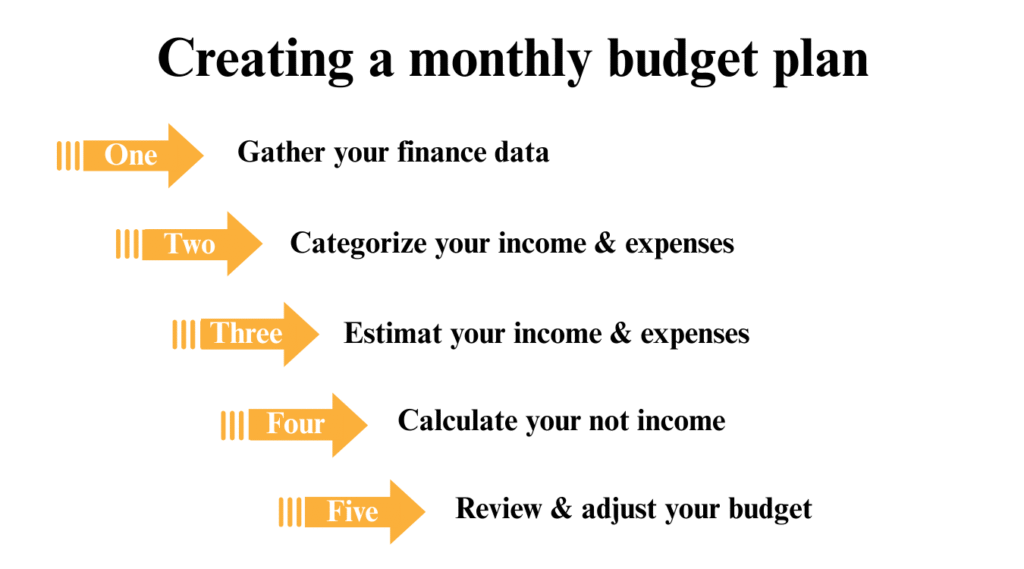

3. Create a Realistic Monthly Budget

Caption: “Your budget should fit your life, not frustrate it.”

A good budget is one that is realistic.

- Follow the 50/30/20 rule:

- 50% Needs (Rent, Groceries, Bills)

- 30% Wants (shopping, movies, eating out)

- 20% Savings & Investments

- Review the budget every month and update it as needed.

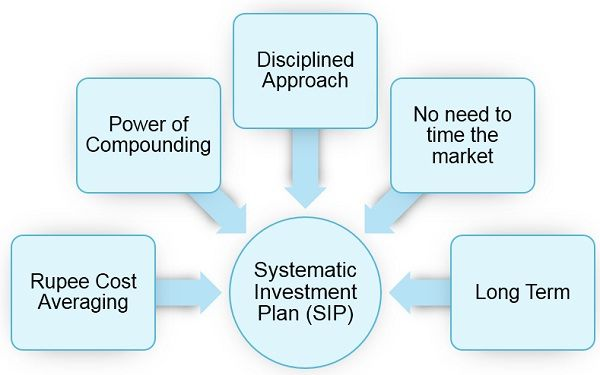

4. Automate Your Savings

Caption: “Pay yourself first — then spend the rest.”

Put 20-30% of your income into auto-saving mode .

- Start a SIP (Systematic Investment Plan) .

- Set up auto-transfers to a separate account.

- By doing this, saving will become a habit.

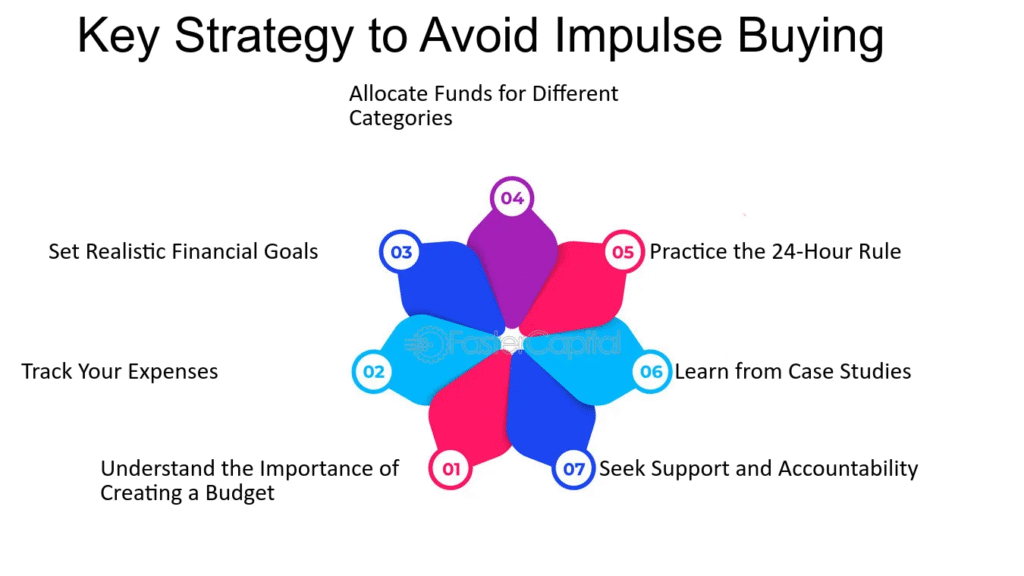

5. Cut Down on Impulse Spending

Caption: “Every small leak sinks the big ship.”

In 2025, online shopping and UPI payments have made spending easier—but they can also ruin budgets.

- Follow the “24-hour Rule” – Don’t buy anything non-essential right away, think about it after 24 hours.

- Check subscriptions (Netflix, Spotify, Gym) — cancel any you don’t use.

6. Use Digital Tools for Budgeting

Caption: “Smart budgeting needs smart tools.”

There are many free and paid tools available today.

- Tools like Mint, YNAB (You Need A Budget), ET Money provide financial insights.

- These tools will alert you when you are spending more than your budget.

7. Cook More, Eat Out Less

Caption: “Your kitchen can save you thousands every year.”

Eating out can quickly ruin your budget.

- Set a target of eating home-cooked food 5 days a week.

- Do meal prep on Sunday to save time during the week.

- Keep track of your food expenses every month.

8. Avoid Unnecessary Debt

Caption: “Debt should be a tool, not a trap.”

- Use your credit card wisely – pay the entire bill on time.

- Do not take excessive personal loan.

- Do not let loan EMIs go beyond 30-35%.

9. Review & Adjust Regularly

Caption: “Your budget should evolve as your life does.”

Review your budget and expenses every month.

- If your salary increases, increase your savings as well.

- If any new expenses arise (Kids School Fees, EMI), adjust the budget.

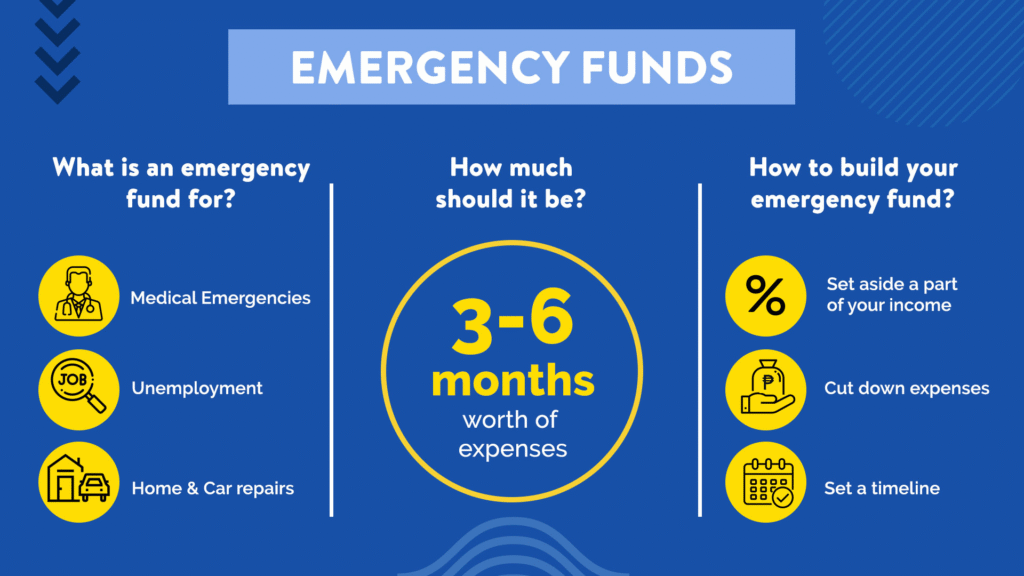

10. Build an Emergency Fund

Caption: “Financial security begins with a backup plan.”

Keep at least 6 months’ expenses in a savings account or liquid fund.

- This will help in sudden expenses (Job Loss, Medical Emergency).

- Avoid spending this fund, use it only in emergencies.

| No. | Smart Budgeting Tip | Quick Implementation Tip |

|---|---|---|

| 1 | Set Clear Financial Goals | Divide your goals into short-term, mid-term, and long-term goals and write them down and track them every month. |

| 2 | Track Every Rupee You Spend | Use an expense tracker app (like Walnut or MoneyView) and record all your expenses, big and small, daily. |

| 3 | Follow the 50/30/20 Rule | Automatically divide income into 50% Needs, 30% Wants and 20% Savings/Investments. |

| 4 | Cut Down Impulse Spending | Follow the 24-hour rule – don’t buy anything non-essential right away, decide after 24 hours. |

| 5 | Build an Emergency Fund | Save at least 3-6 months of expenses and keep it only for emergencies. |

Smart budgeting isn’t just about saving money in 2025, it’s about building a financially strong life. By adopting these 10 methods, you’ll not only have control over your finances but also fulfill your financial dreams. Remember—small changes add up to a big impact.

This article is for educational and informational purposes only . Consult your financial advisor before making any investment or financial decisions.

#PersonalFinance #Budgeting2025 #MoneyTips #SmartBudgeting #Carrerbook #Anslation #FinancialFreedom #WealthBuilding #SavingsGoals #MoneyManagement #InvestingForBeginners #BudgetTips