Saving money doesn’t have to be complicated. With just a few simple adjustments to your daily habits and mindset, you can boost your savings and take control of your financial future. Here are ten easy-to-follow personal finance hacks that can help you keep more of your hard-earned cash.

1. Automate Your Savings

One of the best ways to save consistently is by setting up automatic transfers. By scheduling a small amount to be deducted from your account each payday, you can gradually build up your savings without even thinking about it. Many banks and apps allow you to automate transfers to a savings or investment account, making it easy to save without effort.

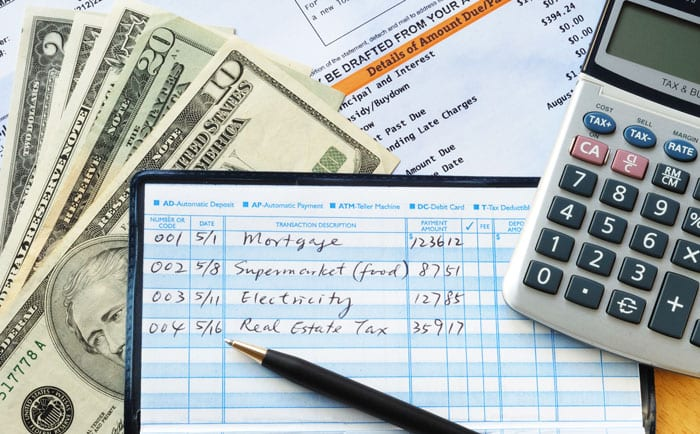

2. Create a Budget That Works for You

Budgeting doesn’t have to be restrictive. The key is finding a budgeting method that fits your lifestyle. Whether it’s the 50/30/20 rule (50% needs, 30% wants, 20% savings) or a zero-based budget, knowing where your money goes every month can help you spot areas to cut back. Tracking your expenses will help you avoid overspending on things that aren’t necessary.

3. Cut Back on Unnecessary Subscriptions

Do you really need all those subscriptions? From streaming services to monthly subscription boxes, many of us pay for things we rarely use. Take a look at your monthly subscriptions and ask yourself if they’re adding value to your life. Canceling just one or two of them can free up a surprising amount of money for savings.

4. Use Cash Back and Rewards Apps

Take advantage of cash-back offers and reward apps when making purchases. There are plenty of apps that offer cash back on everyday spending like groceries, gas, and online shopping. Even if it’s just a few dollars here and there, these rewards add up over time and can contribute to your savings.

5. Set Clear Financial Goals

It’s much easier to stay motivated to save when you have specific goals. Whether you’re saving for a vacation, a new gadget, or building an emergency fund, having a clear target in mind gives your savings a purpose. Write down your goals and break them into smaller, achievable milestones to make them feel less overwhelming.

6. Pay Off High-Interest Debt First

If you’re carrying high-interest debt, especially from credit cards, it can be hard to make progress with saving. Paying off that debt as soon as possible should be a priority. Once the high-interest debt is gone, you can start focusing more on saving for the future.

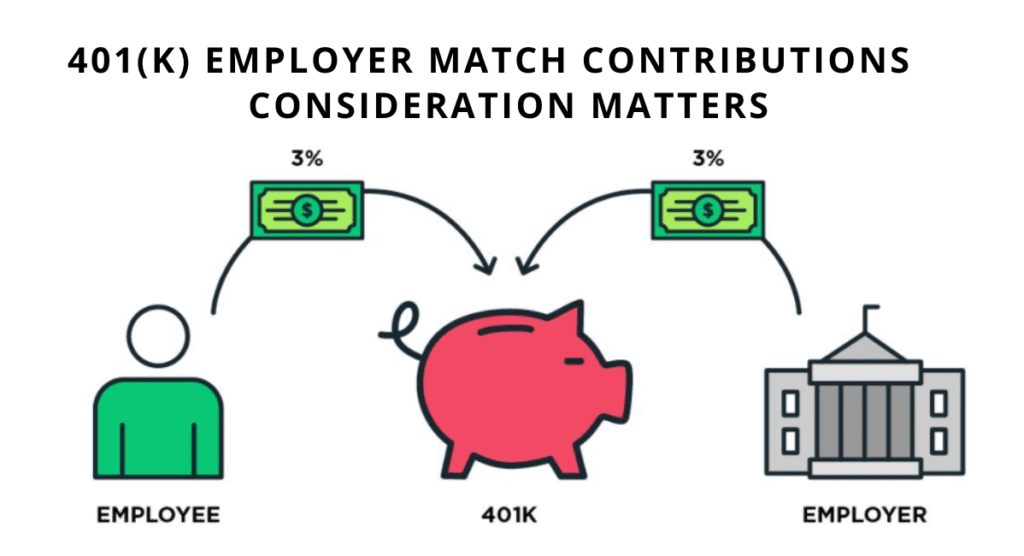

7. Take Advantage of Employer Matching Contributions

If your employer offers a retirement plan with matching contributions, be sure to take full advantage of it. Not contributing up to the match is essentially leaving free money on the table. If possible, try to increase your contribution gradually over time to build a strong retirement savings foundation.

8. Shop Smarter and Use Discounts

Before making purchases, take a few minutes to compare prices online or look for coupon codes. Many retailers offer seasonal discounts or email promotions. Apps that help you find deals and track prices can help you save money on everyday essentials and big-ticket items alike.

9. Downsize Your Housing Costs

Your living situation plays a huge role in your financial health. If you’re spending a large portion of your income on rent or a mortgage, it might be time to reassess. Consider downsizing or moving to a less expensive area. Alternatively, renting out a spare room can help offset housing costs and free up more money for savings.

10. Embrace the 24-Hour Rule

Impulse buying is a common savings killer. To avoid spending money on things you don’t need, try adopting the 24-hour rule. When you want to make an unplanned purchase, give yourself 24 hours to think it over. This simple pause can help you make more thoughtful spending decisions and keep unnecessary purchases in check.

Final Thoughts

These simple personal finance hacks don’t require major life changes, but they can make a big difference over time. By automating your savings, cutting unnecessary expenses, and shopping smarter, you can start building your savings today. The key is consistency – small, steady improvements will lead to big results down the line.

By incorporating these simple personal finance hacks into your daily routine, you can start building a strong foundation for your financial future. Remember, small steps add up over time, and staying consistent is the key to achieving your savings goals. Whether it’s automating your savings or being more mindful about your spending, every action you take brings you closer to financial freedom.

The advice provided in this article is for informational purposes only. It is not intended as financial, legal, or professional advice. Please consult with a certified financial advisor before making any major financial decisions.

#PersonalFinance #MoneySavingTips #FinancialGoals #Budgeting #Carrerbook #Anslation #CashBack #DebtFreeJourney #SavingsHacks #InvestSmart #FinancialFreedom #MoneyManagement #SmartSpending