Earning money is easy, but managing and growing it is the real art. Are you ready to grow your money smartly.

Today’s millennial generation (people born in the 90s and 2000s) has progressed a lot in their career, relationships and lifestyle. But to be honest, when it comes to personal finance , most people are confused.

When I started working, I could not understand how to use my salary properly. My pocket would always be empty by the end of the month. I gradually learned in small steps and found that earning money is an art but saving and increasing money is a responsibility.

In this blog, I will share with you my experiences and easy tips that every millennial should understand.

1. Making a budget is the first step

When I first wrote down my salary and expenses in an Excel sheet, I was shocked. Small expenses like going out for coffee every day, ordering food online, etc. used to eat up a lot of money.

Tip:

- Follow the 50-30-20 rule (50% needs, 30% wants, 20% savings).

- Use digital budgeting apps.

2. Use credit cards wisely

Credit card was a problem for me in the beginning. I used to spend without thinking after seeing the offers and later had trouble paying the bill.

Lesson: Credit card is not an enemy, but a friend if used correctly.

- Pay bills on time.

- Do not spend more than the limit.

- Use cashback and reward points wisely.

3. Get into the habit of saving

Millennials often say “live now, save later.” But the truth is, even small savings go a long way in the long run.

- As soon as you receive your salary, put 20% of it in your savings account.

- Start a Recurring Deposit (RD) or SIP.

- Make saving a priority over spending.

4. Investing is important

When I invested my first SIP, I was afraid that my money might go down the drain. But with time, I realized that investing is the strongest way to grow money.

- Mutual Funds (SIP)

- Share Market (Be careful)

- Gold Bonds

- Real estate (for long term)

5. Don’t ignore insurance

Initially, I thought of insurance as a “useless expense”. But once I had to spend a lot in a health emergency and then I realized that insurance is security.

- Health Insurance

- Term Insurance

- Vehicle and property insurance

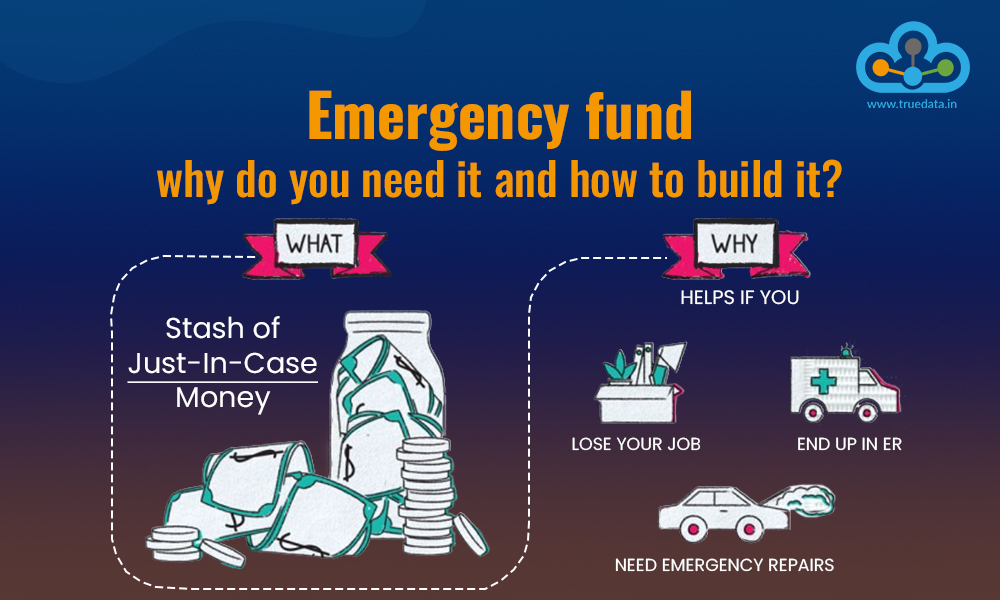

6. Create an emergency fund

During the time of Covid-19, I understood how important an emergency fund is.

- Keep at least 6 months of expenses in a separate account.

- Use this fund only in emergencies.

7. Increase your financial knowledge

Whenever I learned something new from a book or blog, I applied it practically and felt the difference.

- Read books like Rich Dad Poor Dad .

- Listen to podcasts.

- Do online courses.

8. Balance between relationships and money

We Indians have a habit of not discussing money openly in relationships. But transparency is very important with your partner or family.

- If you are married, then combine the budget and savings of both.

- Don’t spend wastefully under pressure from friends.

9. Start a side hustle

For me, blogging was a side hustle, which later became a source of income.

- Freelancing

- Youtube/Blogging

- Online course or coaching

10. Use technology

Everything is digital in today’s time.

- Track expenses via UPI and digital wallets.

- Use investment apps (Groww, Zerodha).

- Set up automatic saving.

11. Don’t stress about money

Personal finance is not just about numbers, it is about mental peace.

- Set small targets.

- Don’t put pressure on yourself.

- Consider money as a part of life, not life itself.

| No. | Tip | Description |

|---|---|---|

| 1 | Budgeting is Key | Create a monthly budget and track all your income and expenses. This will help you identify where you can save. Use apps to make it easier. |

| 2 | Start Saving Early | Make it a habit to save a fixed percentage of your income every month. Automate transfers to your savings account to ensure consistency. |

| 3 | Invest Smartly | Begin investing early through SIPs or mutual funds. Diversify your investments and focus on long-term growth instead of short-term gains. |

| 4 | Build an Emergency Fund | Set aside 6 months’ worth of expenses in an easily accessible account to cover unforeseen circumstances like medical emergencies or job loss. |

| 5 | Avoid Unnecessary Debt | Don’t fall into the trap of overspending. Pay off high-interest debts like credit cards first. Avoid borrowing unnecessarily, and focus on living within means. |

The biggest secret for millennials is to start early and be consistent. Small steps like budgeting, saving, starting a SIP and buying insurance add up to a steady growth in your wealth. Remember, money is not just for spending, but also for securing your future.

This blog is based on my personal experiences and general knowledge. Consult your financial advisor before making any investment and money related decisions.

“Earning money is easy, but managing and growing it is the real art. Are you ready to grow your money smartly?”

#PersonalFinance #MillennialsMoney #FinancialFreedom #Carrerbook #Anslation #MoneyManagement #SavingsTips #InvestSmart #Budgeting #WealthBuilding #SmartFinance #FinancialGoals